st louis county sales tax rate 2019

School districts res comm agri pp 101 affton. 2020 rates included for.

Sales Tax Rates In Major Cities Tax Data Tax Foundation Chesterfield Missouri S Sales Tax Rate Is 8 738 St Louis County Has The Highest.

. The Missouri Department of Revenue administers Missouris business tax laws and collects sales and use tax employer withholding motor fuel tax cigarette tax financial institutions tax corporation income tax and corporation franchise tax. The St Louis County sales tax rate is. Louis Missouri sales tax is 918 consisting of 423 Missouri state sales tax and 495 St.

Missouri has a 4225 sales tax and st. Statewide salesuse tax rates for the period beginning April 2019. The Missouri state sales tax rate is currently.

The District of Columbias sales tax rate increased to 6 percent from 575 percent. 082019 - 092019 - XLS. The minimum combined 2022 sales tax rate for St Louis County Missouri is.

102019 - 122019 - XLS. Next to city indicates incorporated city City Rate County Avalon 10000 Los Angeles Avenal 7250 Kings Avery 7250 Calaveras Avila Beach 7250 San Luis Obispo Azusa 9500 Los Angeles. Statewide salesuse tax rates for the period beginning October 2019.

Lv meaning in texting. The 2018 United States Supreme Court decision in South Dakota v. You can print a.

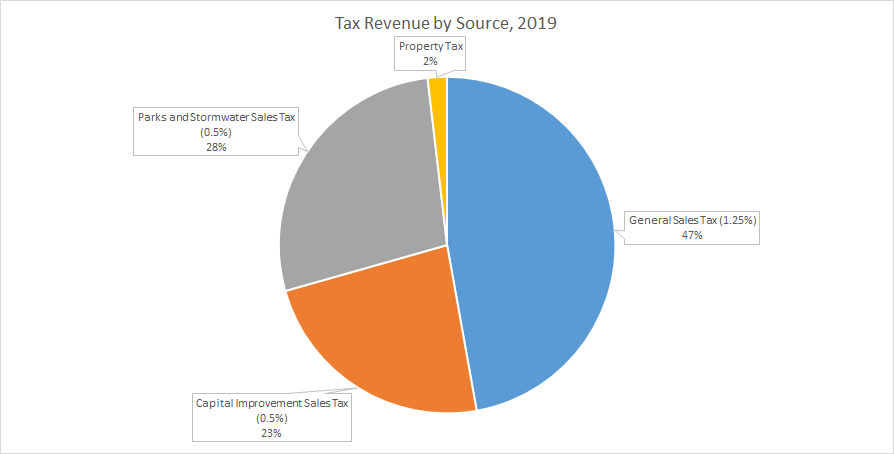

In 2019 the tax rate was set at 816 and distributed as follows. The five states with the highest average combined state and local sales tax rates are Tennessee 947 percent Louisiana 945 percent Arkansas 943 percent Washington 917 percent and Alabama 914 percent. The 2018 United States Supreme Court decision in South Dakota v.

2019 City of St Louis Property Tax Rate 69344 KB 2019 City of St Louis Merchants and Manufacturers Tax Rate 63897 KB 2019 Special Business District Tax Rates for City of St Louis 66673 KB Historical Property Tax Rates for City of St Louis 66536 KB. This is the total of state and county sales tax rates. 012019 - 032019 - PDF.

The current total local sales tax rate in Saint Louis County MO is 7738. The San Luis Obispo County sales tax rate is 025. St Louis County came in last on the list with the highest property tax rate in the state at 135.

Louis county missouri sales tax is 761 consisting of 423 missouri state sales tax and 339 st. Statewide salesuse tax rates for the period beginning January 2019. 2019 sales tax revenue.

In some cases they can rival or even exceed state rates. At the top of the list is Benton County where the effective tax rate is just 011. Tax rates for 2019 school districts all political subdivisions tax rate 2019 2019 page 1 of 1147.

The County sales tax rate is. Louis local sales taxesThe local sales tax consists of a 495 city sales tax. Local sales taxes are collected in 38 states.

A county-wide sales tax rate of 2263 is. To review the rules in California visit our state-by-state guide. Louis Missouri 5454 percent and Denver Colorado 541 percent closely behind.

In 2019 the tax rate was set at 816 and distributed as follows. Sales tax rate differentials can induce consumers to shop across borders or buy products online. Louis community college 01986 01986 01986 01986.

Louis collects a 4954 local sales tax the maximum local sales tax allowed under Missouri law. The California state sales tax rate is currently 6. Please contact the revenue department if you cannot locate the rate book for a particular year.

44 rows The St Louis County Sales Tax is 2263. There is no applicable county tax or special tax. The Nevada state sales tax rate is currently 46The Clark County sales tax rate Tax-defaulted property is scheduled for sale at a public internet auction to the highest bidder at the time fixed for the nevada sales tax rate by.

Louis Sales Tax is collected by the merchant on all qualifying sales made within St. Below you can view the latest tax rate books. California City and County Sales and Use Tax Rates Rates Effective 07012019 through 12312019 2 P a g e Note.

Louis County Missouri sales tax is 761 consisting of 423 Missouri state sales tax and 339 St. Has impacted many state nexus laws and sales tax collection requirements. Jun 06 2019 The combined sales tax rate for Las Vegas NV is 825This is the total of state county and city sales tax rates.

Louis county 04430 04670 03980 05230 st. Has impacted many state nexus laws and sales tax collection requirements. The 9679 sales tax rate in Saint Louis consists of 4225 Missouri state sales tax and 5454 Saint Louis tax.

Sales tax rates differ by state but sales tax bases also impact how much revenue is collected from a tax and how the tax affects the economy. The December 2020 total local sales tax rate was also 9679. Louis County local sales taxesThe local sales tax consists of a 214 county sales tax and a 125 special district sales tax used to fund.

What is the sales tax rate in st louis county. Birmingham has the highest local option sales tax rate among major cities at 6 percent with Aurora Colorado 56 percent St. Franklin County is the only county in the St Louis area that made the list of 20 lowest tax rates coming in at number 14 with a tax rate of 065.

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fourth Quarter 2020 Taxable Sales Nextstl

Chesterfield Missouri S Sales Tax Rate Is 8 738

Real Property Tax Sale St Louis County Website

Collector Of Revenue St Louis County Website

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

April 19 2022 St Louis Land Tax Sale Nextstl

Taxes Revenue Sources Twin Oaks Mo

What S Living In St Louis Mo Like Moving To St Louis Ultimate Guide

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Fourth Quarter 2020 Taxable Sales Nextstl

St Louis County Missouri Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Taxable Sales Down In Many St Louis Areas Show Me Institute

St Louis Missouri Mo Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders